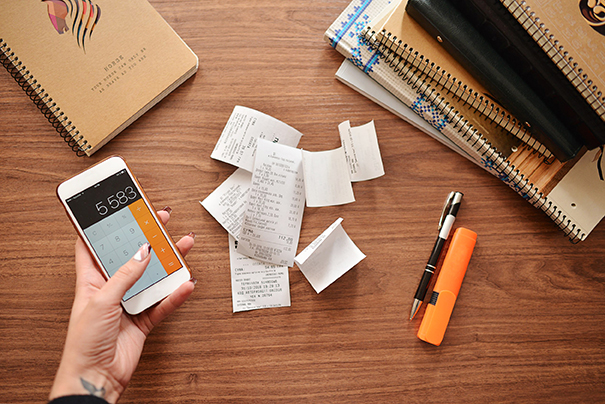

How to save money fast on small income is never the question; how to save money with whatever you have at hand is the real deal. The early days of […]

10 Ways On How To Save Money Fast On Low Income

Editor's picks

- Migliori Siti Non Aams

- Online Casino

- Non Gamstop Casinos

- Non Gamstop Casinos UK

- Migliori Casino Online

- New Betting Sites UK

- Casino Not On Gamstop

- Casino Sites Not On Gamstop

- Paris Sportif En Crypto

- Betting Sites Not On Gamstop

- Online Casinos

- Slots Not On Gamstop

- Meilleur Casino En Ligne

- Gambling Sites Not On Gamstop

- Non Gamstop Casinos

- UK Online Casinos Not On Gamstop

- Casino Online Non Aams

- Online Casinos

- Non Gamstop Casinos UK

- Betting Site

- Slot Sites Uk

- Casino En Ligne France

- Meilleur Casino En Ligne

- UK Casinos Not On Gamstop

- Non Gamstop Casinos

- UK Casinos Not On Gamstop

- Casino Non Aams Italia

- Jeux Casino En Ligne

- Lista Casino Online Non Aams

- Meilleur Site De Poker En Ligne

- Meilleur Site De Paris Sportif International

- Casino Live

- 온라인홀덤

- Casino En Ligne Fiable

- Meilleur Casino En Ligne France

- Casino Italiani Non Aams

- 카지노 해외 사이트

- Casino Retrait Rapide

- 코인카지노 사이트