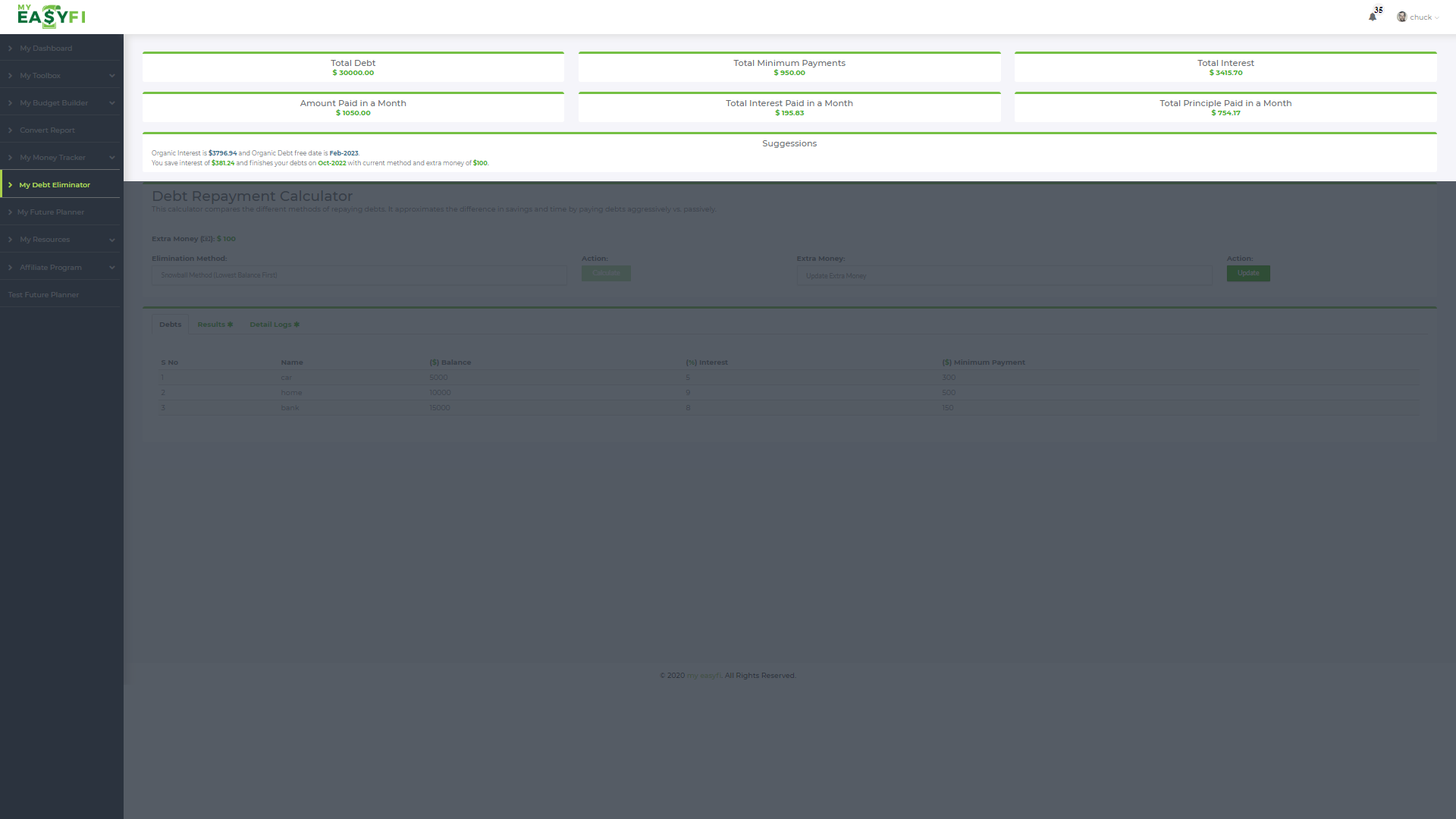

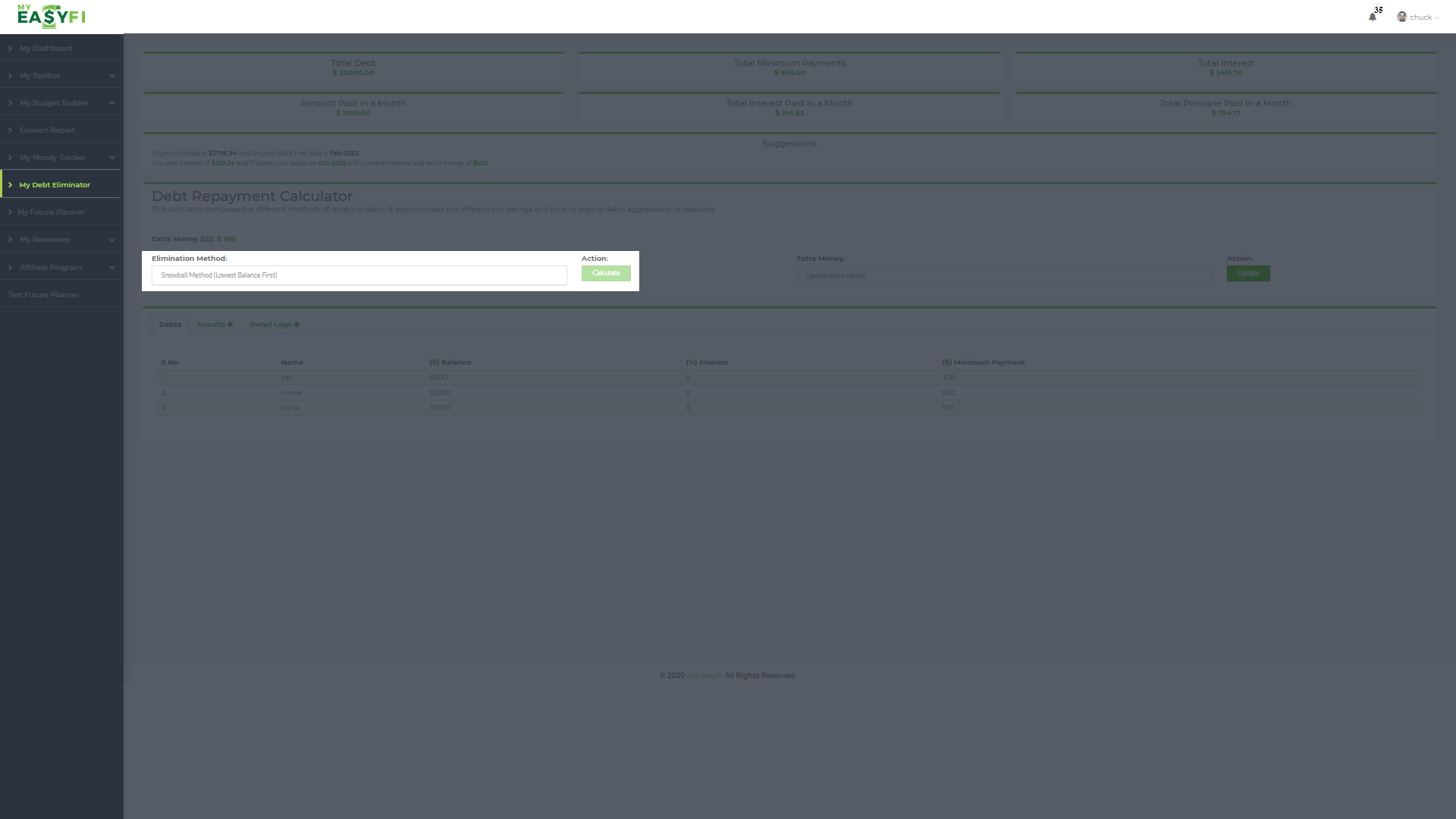

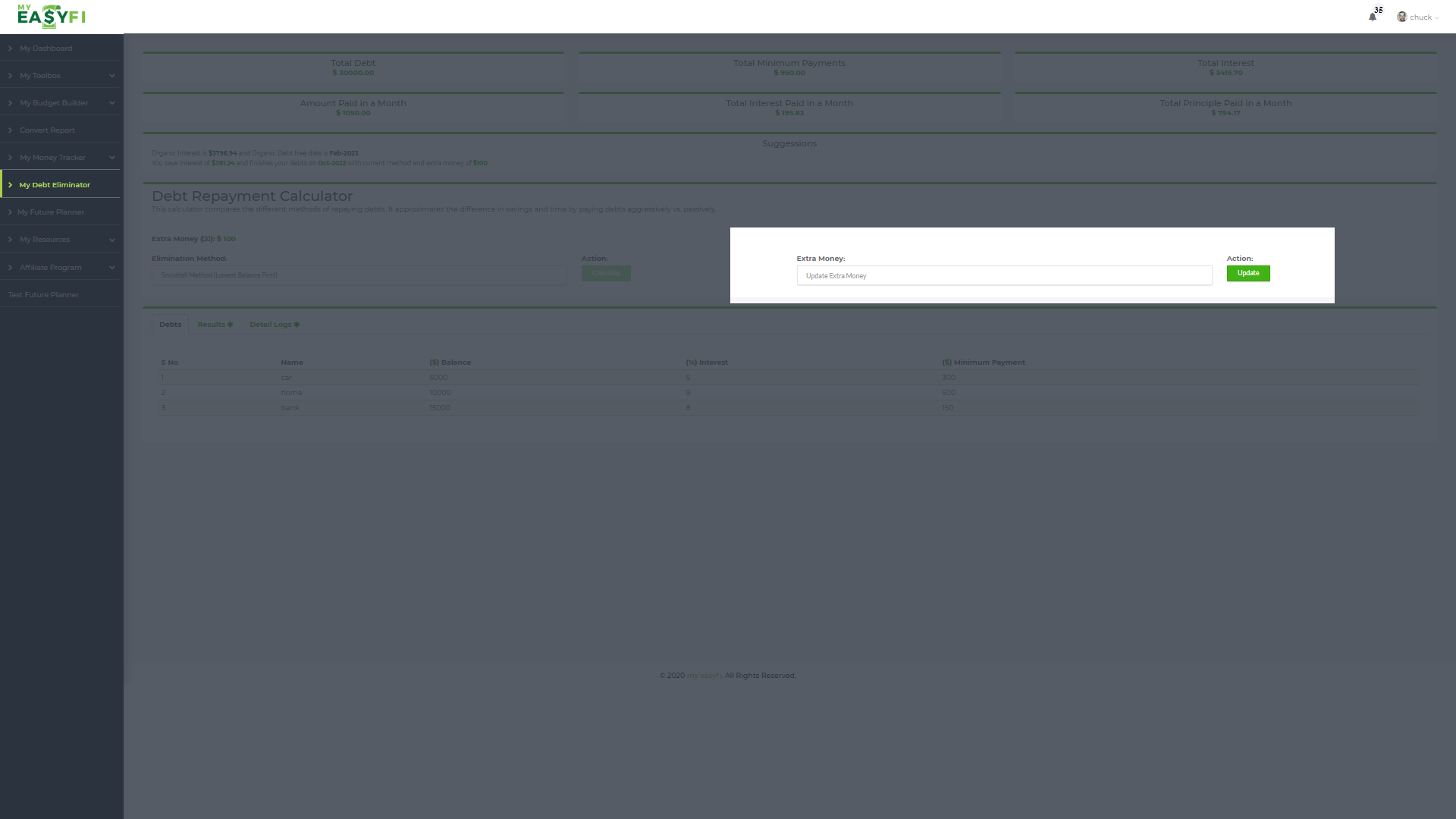

Shed Debt Like Leaves In Autumn With My EasyFi’s Debt Tracker App

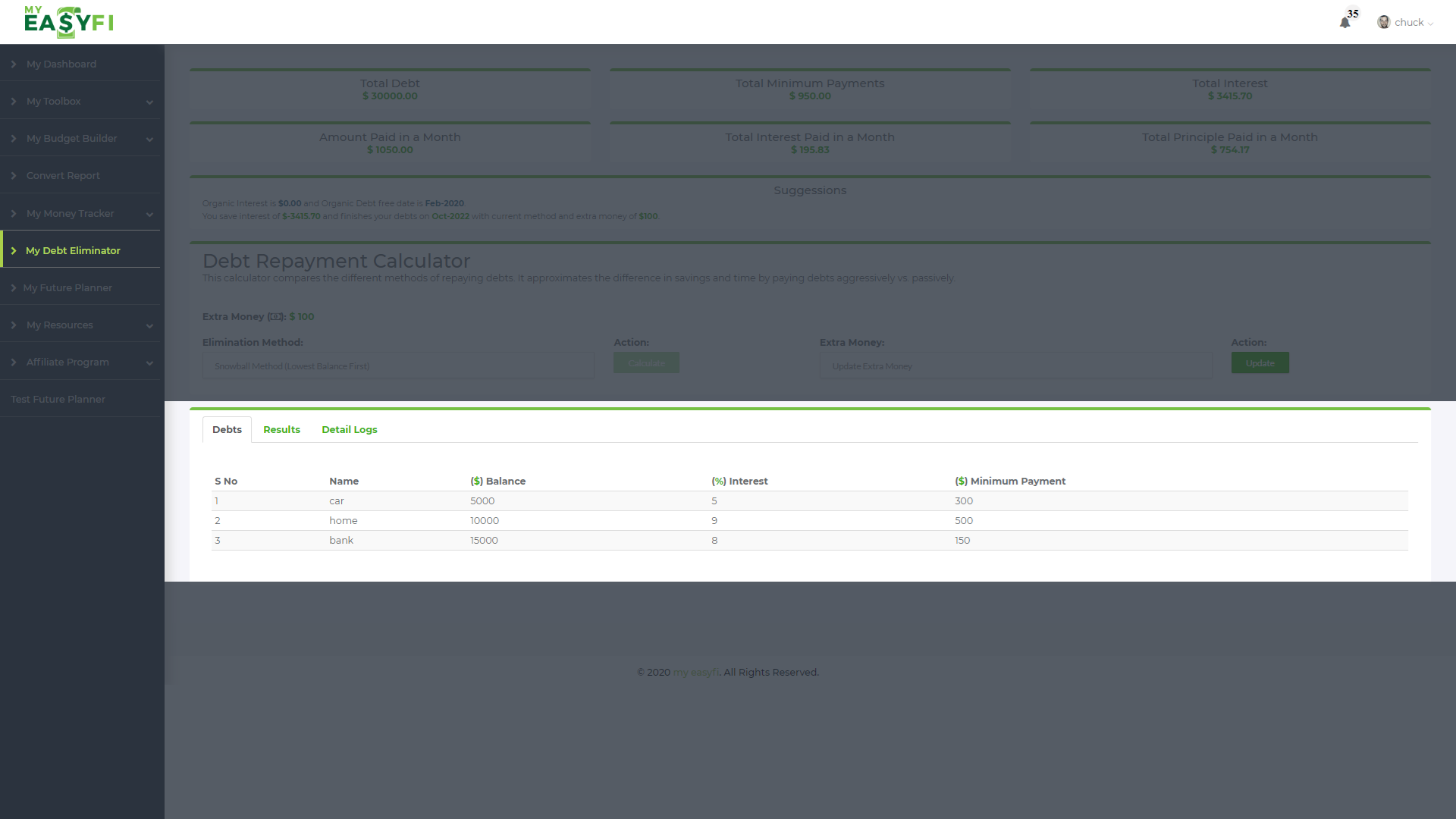

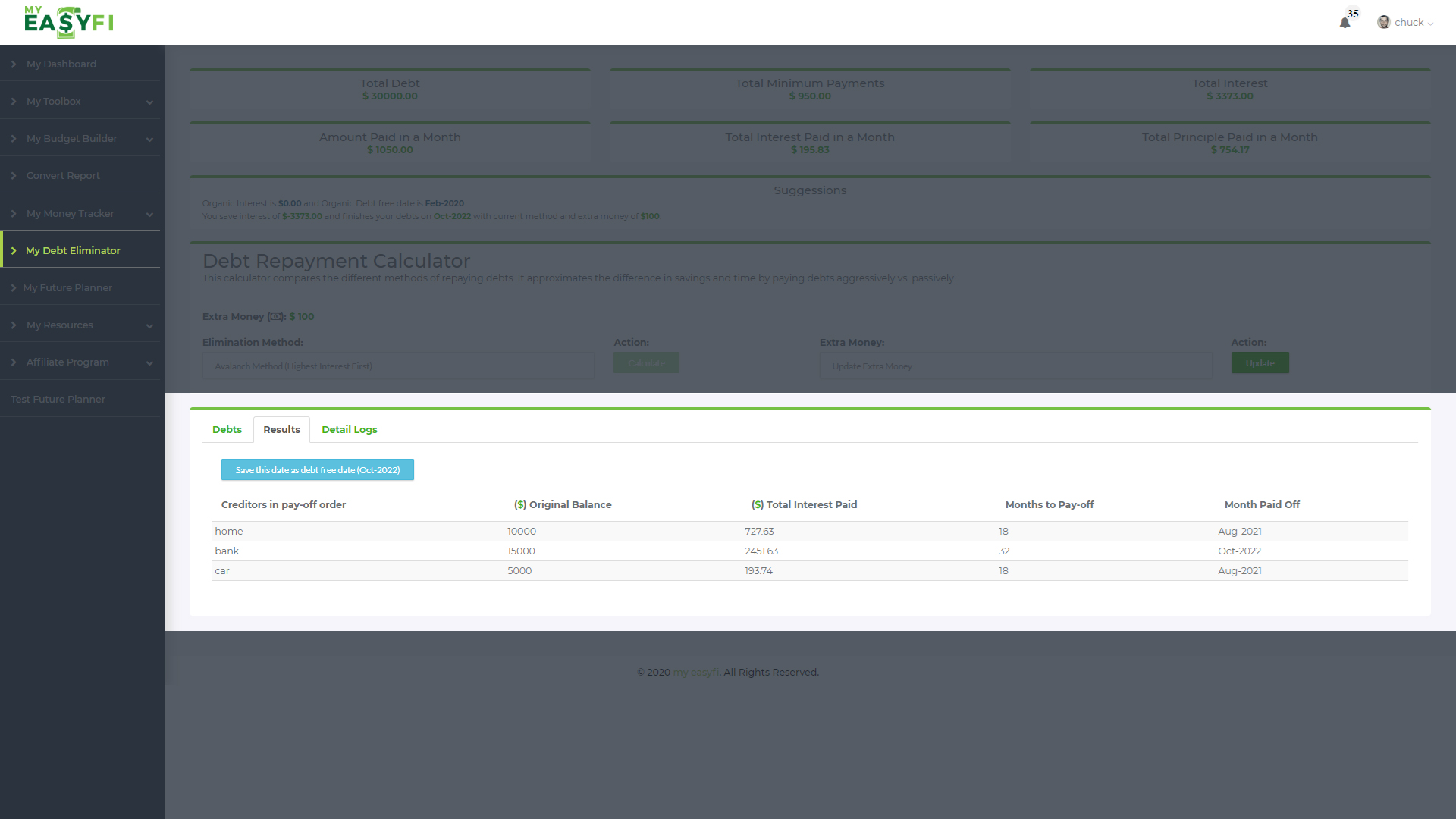

Burdened with the infamous financial debt? Want to pay off student loans? Need to secure a debt-free future? My EasyFi is your debt tracker app to cut the loans short from hindering your future. While we help you save, we also help plan your debt payments intelligently.