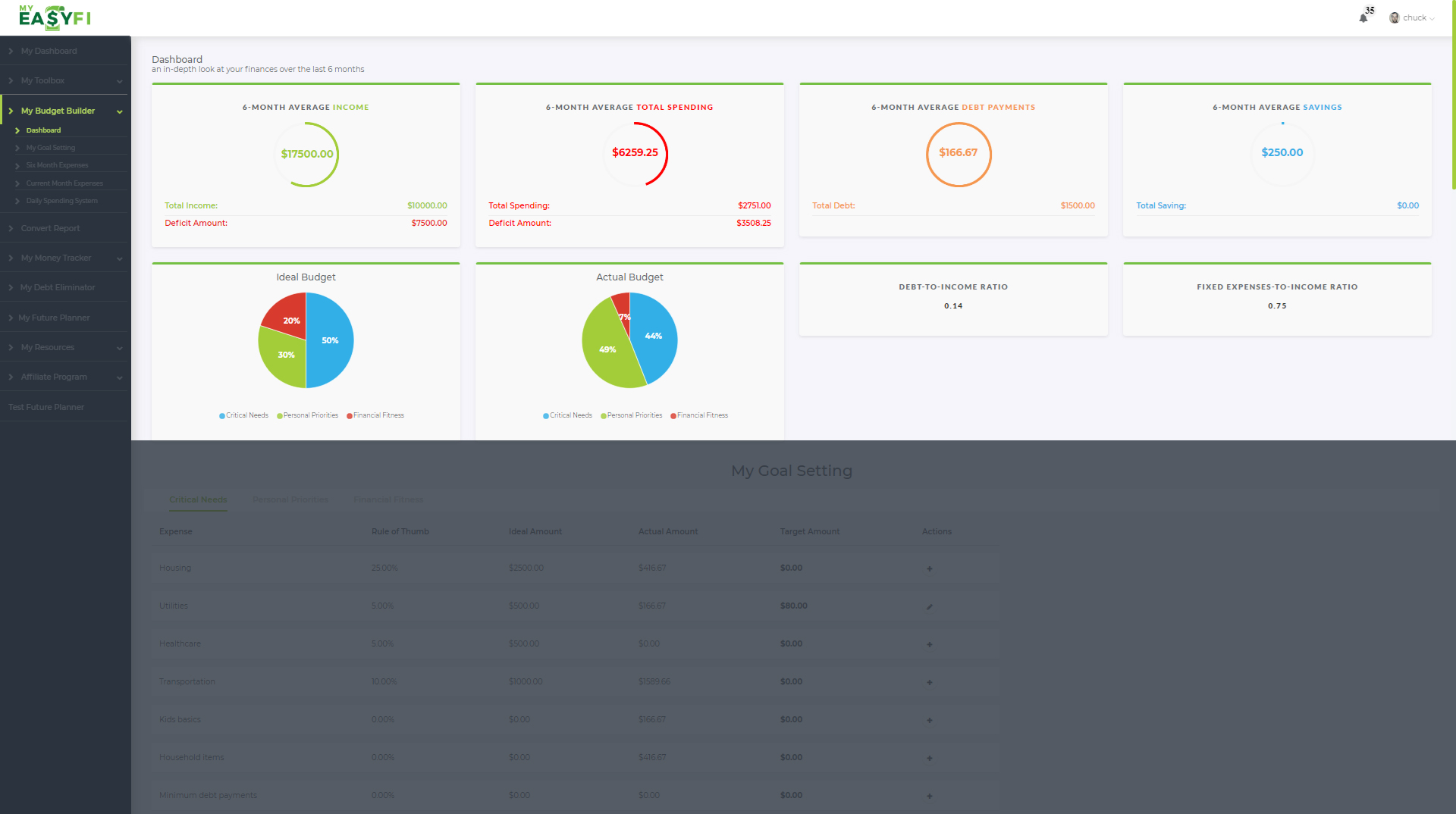

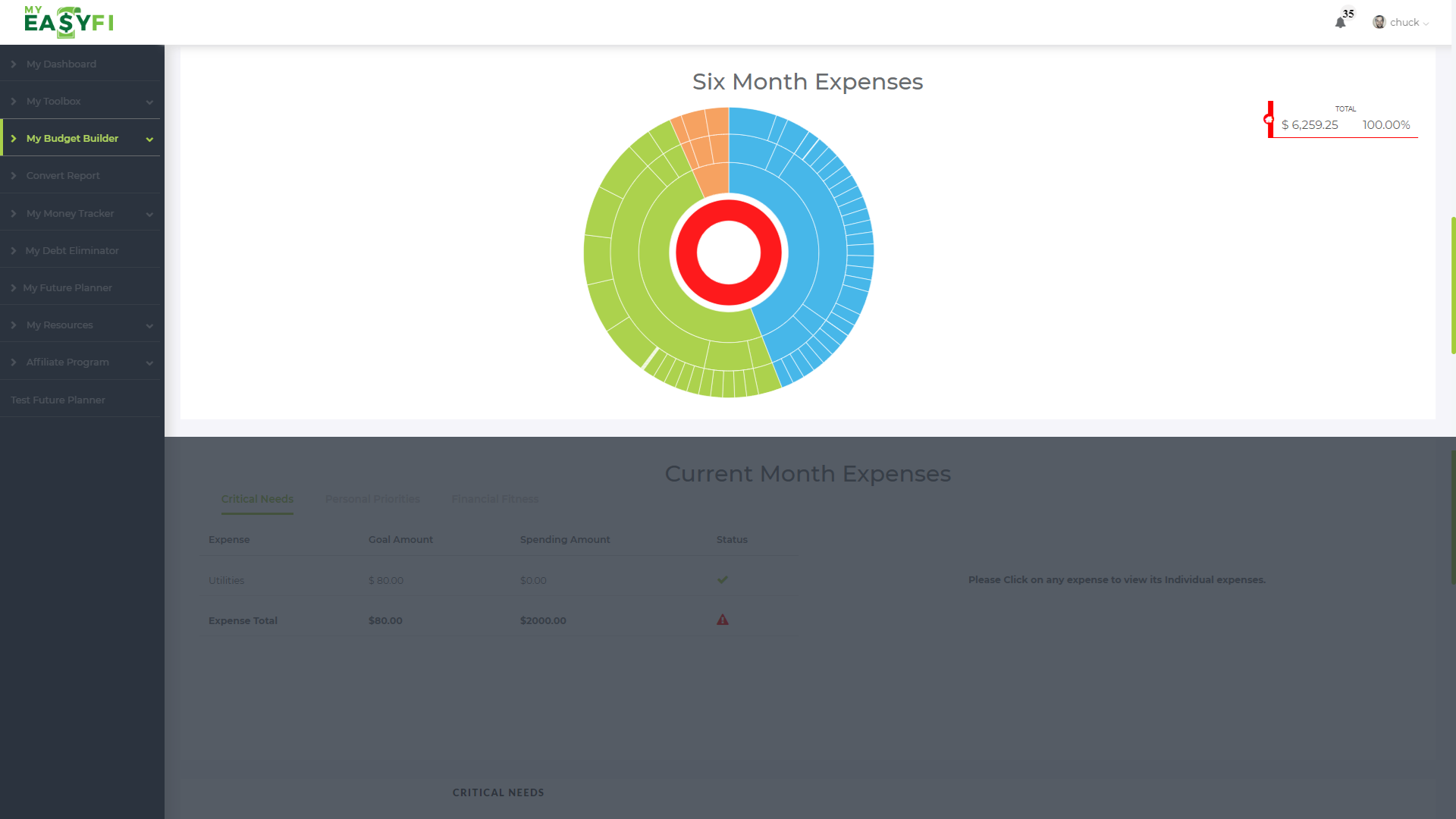

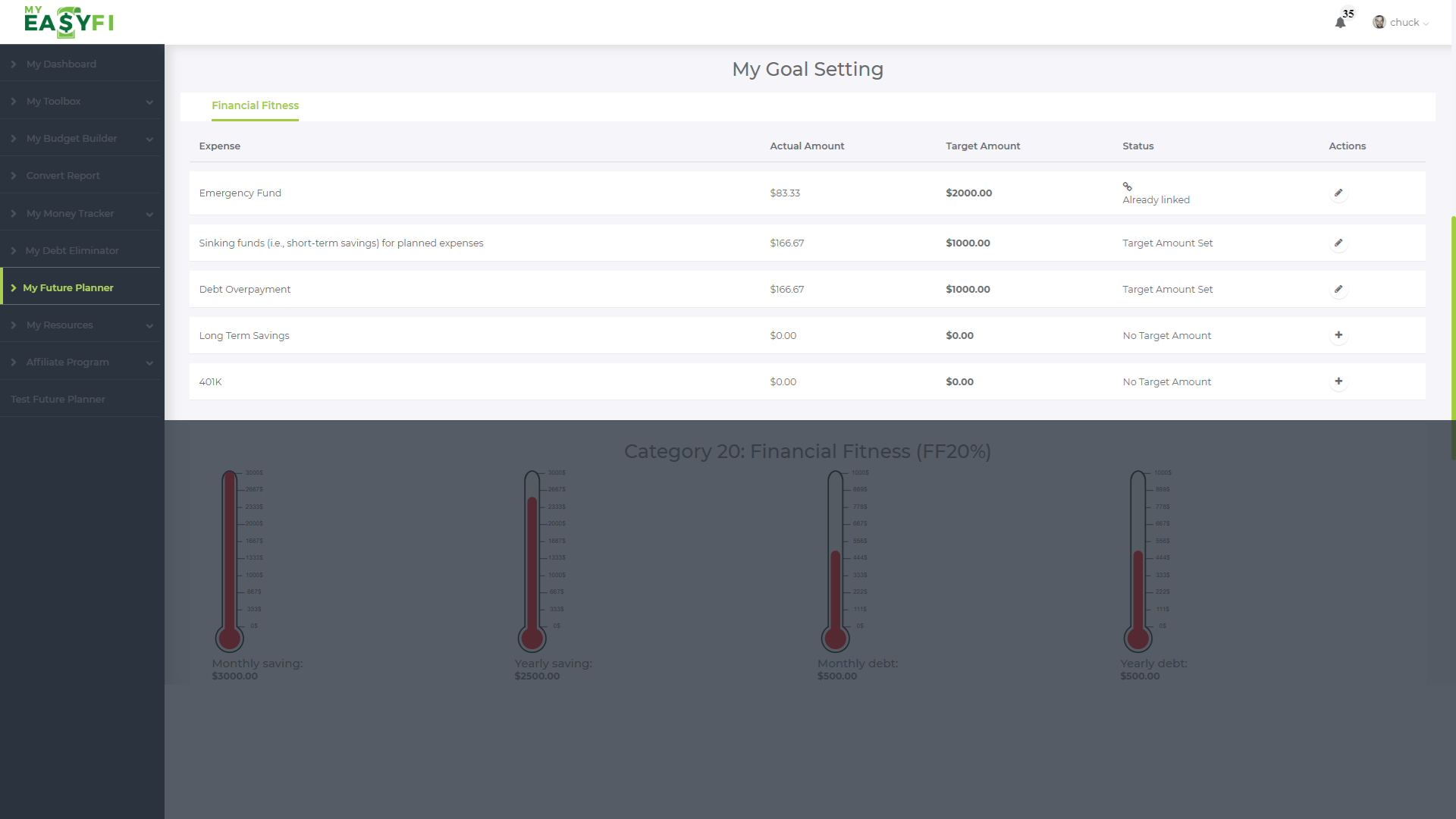

Discover The Best Monthly Budget Builder For Successful Budgeting

Budgets are the best, but they can still send chills down your spine. You don’t have to worry when you’ve got My EasyFi’s budget controller. Let’s smoothen the seams in your monthly financial plans and hit the sweet budget spot.