Differentiate Your Money Plan With The Best Financial Planning Software

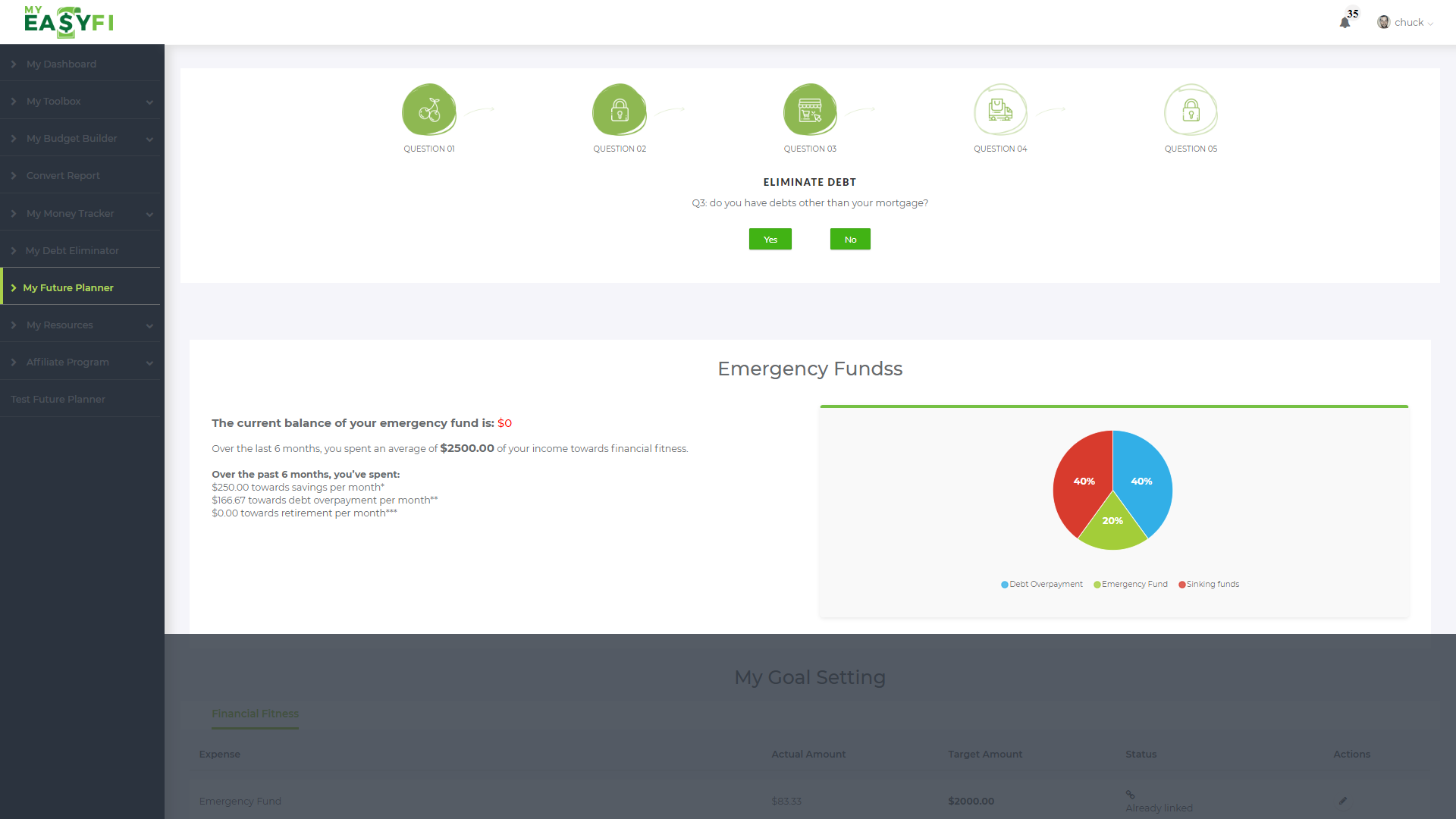

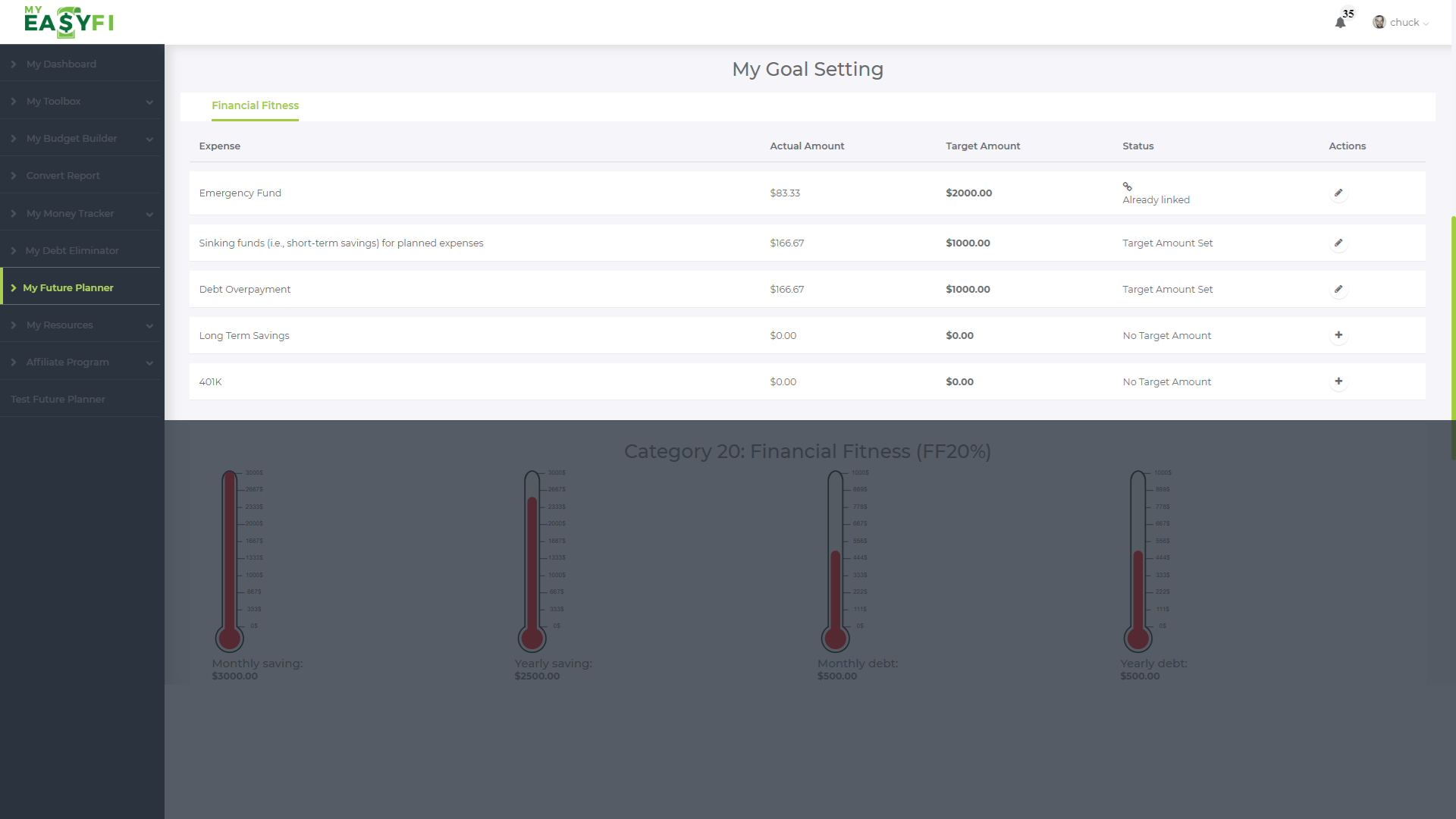

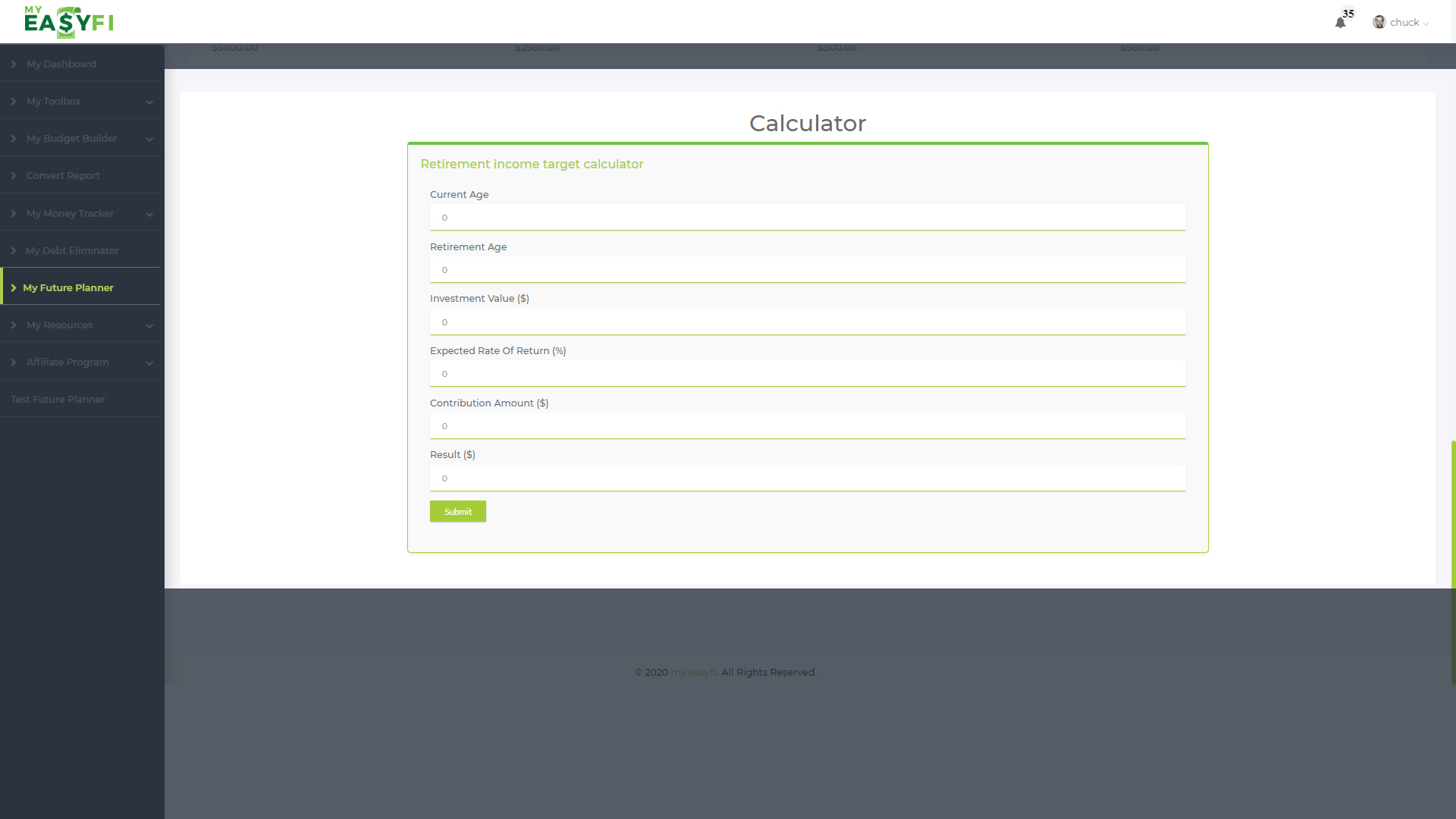

What will you do if the plans you made aren’t enough to stabilize the future? What if your retirement plans don’t turn out as you expected? To seed your plans accurately, you need the best financial planning software to keep track of your past, current, and future expenses. My EasyFi rolls out the most exceptional financial planning tools to make sure you’re securing your finances the right way.